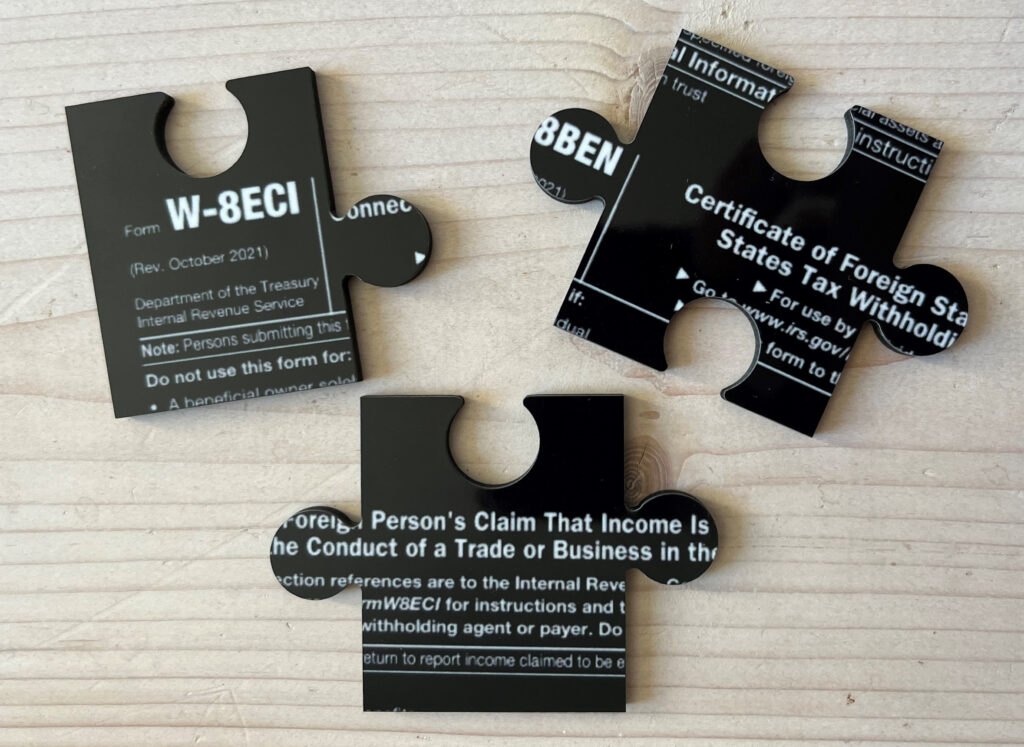

Flowchart: What is a “tax-favored foreign retirement trust” per §6048 regulations ?

The below flowchart helps you determine if a foreign retirement account may qualify as a tax-favored foreign retirement trust; of course, this is not intended to be legal nor tax advice. This flowchart expands upon the article written for Bloomberg’s Tax Management International Journal by Arielle Tucker and myself, you my find the article here …

Flowchart: What is a “tax-favored foreign retirement trust” per §6048 regulations ? Read More »