Foreign Account Tax Compliance Act - FATCA

What is FATCA?

Basics

FATCA, the Foreign Account Tax Compliance Act, has the intention of preventing US taxpayers from not properly reporting income and or assets held in foreign accounts. In practical terms, this requires non-US banks to file an appropriate W-8 series form for every account to indicate if the account holder is a US taxpayer or not.

Compliance

FATCA compliance takes different forms depending on one’s classification under FATCA. An individual US taxpayer generally complies by completing Form 8938 to report certain foreign assets.

Foreign Financial Institutions (FFIs) will have different reporting requirements depending if they are in a Model 1 or Model 2 type jurisdiction; see below for more detail.

What is an IGA?

How is account holder information provided to the US?

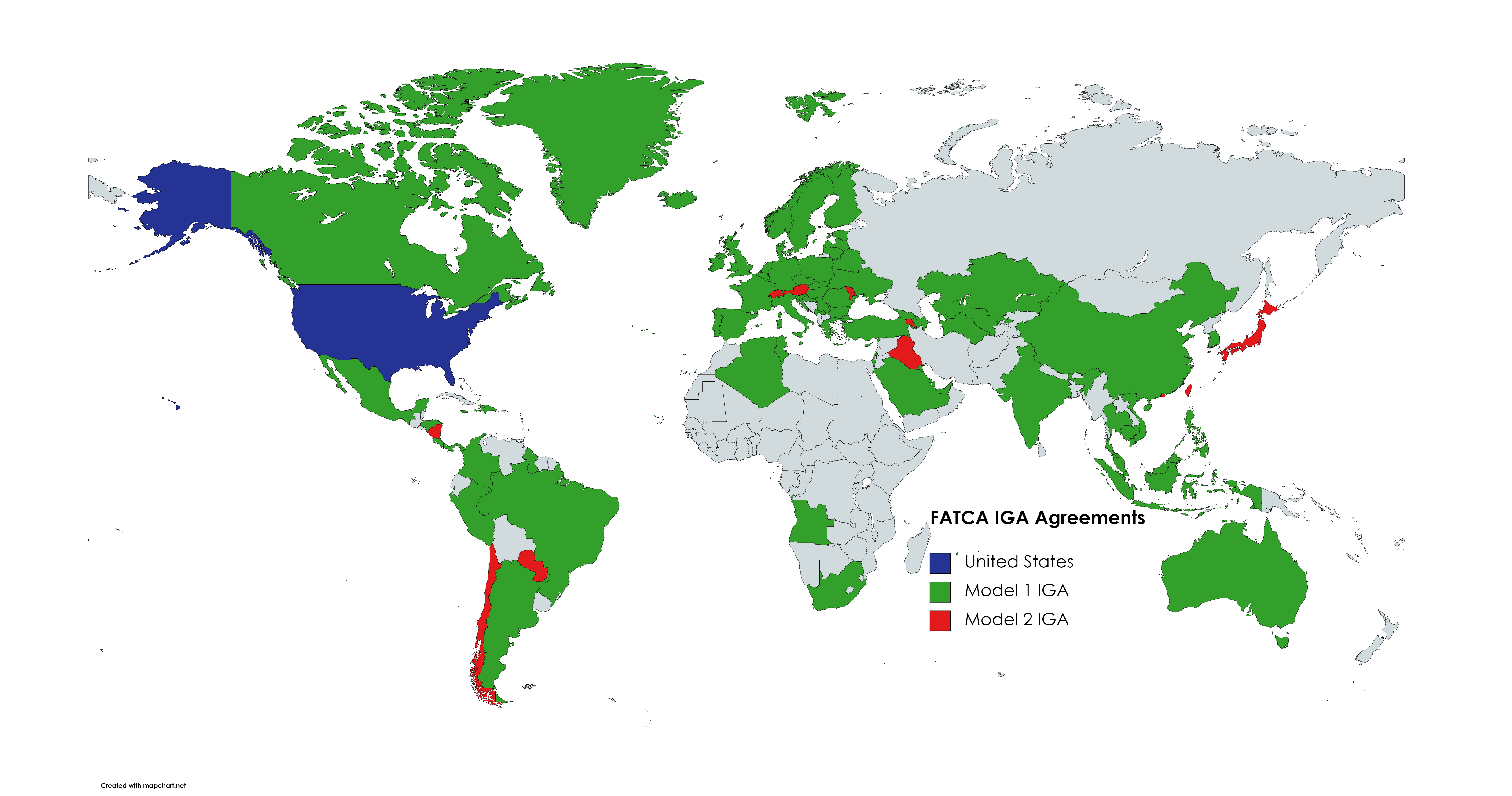

Information on foreign accounts is provided (pursuant to FATCA) under two broad schemes; Model 1 and Model 2. Each specific agreement between the US and a foreign jurisdiction may be modified from the standard models, so please get qualified advice on any FATCA issue.

Under Model 1 type agreements, there is a local agency (normally some part of the national revenue or treasury department) which collects all the US account holder information in that jurisdiction and sends it off to the US Treasury.

Under a Model 2 type agreement, each FFI (Foreign Financial Institution), such as a bank, directly reports its US account holder information to the US Treasury.

In Europe, most countries have entered into a Model 1 type agreement, however Switzerland and Austria have Model 2 type agreements. If you are an FFI in Austria or Switzerland and have questions on FATCA compliance, please reach out to us.

US Treasury Resources

Please check the following link for up to date information: Foreign Account Tax Compliance Act | U.S. Department of the Treasury

Free Estimation

Request A Quote

We generally perform work on a fixed fee arrangement, but may enter in other arrangements as suits.