Corporate Transparency Act Made Simple

As an EU based company, we are fully GDPR & Swiss nFDAP Compliant.

Please note, as of March 6, 2025 the CTA rules are often changing, please contact Tax Logicians directly if you have questions on filing.

Not all of the information below reflects the current status, but we are waiting until new rules are issued in late March 2025 before updating.

F.A.Q.

Corporate Transparency Act Basic Information

All existing Reporting Companies (as of January 1, 2024) and any newly created companies which are created after January 1, 2024; unless they fall under an exemption (see below).

Pending FinCEN’s must recent guidance, existing companies have until January 1, 2025 to file their inital CTA (so a full year).

Reporting Companies formed on or after January 1, 2024 currently have 30 days to file their inital report; FinCEN has made a proposal to extend this deadline to 90 days, but such proposal has not yet become official.

If any of the reported information changes, or a person obtains Beneficial Owner status in respect to a Reporting Company, then the Reporting Company must update their CTA filing within 30 days.

For each Beneficial Owner the following information is required:

• Full name

• Date of birth

• Address in their resident tax jurisdiction, and

• A unique identifying number and issuing jurisdiction from an acceptable identification document (and the image of such document).

• Additionally, the rule requires that reporting companies created after January 1, 2024, provide the four pieces of information and document image for company applicants.

- Anyone who owns or controls 25% or more of an entity; or

- Anyone who exercises Substantial Control over an entity

The concept of Substantial Control is generally very broad. Additionally, FinCEN reserves the right to make its own determinations as to what is Substantial Control.

Please review our related materials below and contact us if you have any questions.

Certain classes of individuals are excluded from being considered Beneficial Owners; but this may require a detailed analysis. Some indiviuduals which may qualify for exemption

Certain classes of individuals are excluded from being considered Beneficial Owners; but this may require a detailed analysis. Some individuals which may qualify for exemption are:

- Minor children, though a parent or legal guardian must supply the identifying information in their place.

- Secure and encrypted portal

- Simplifies multiple entity reporting

- Easy updates and changes

- Analysis of complex entity structures

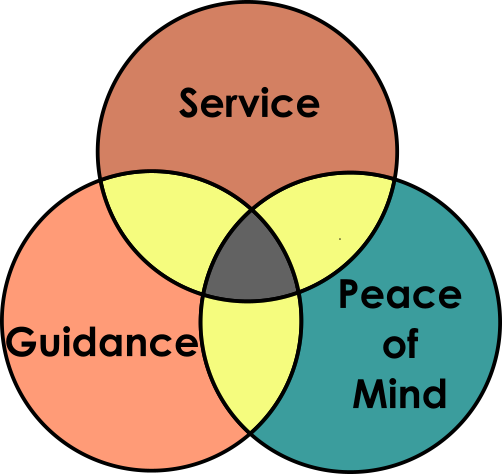

Contact Tax Logicians to get the guidance you need. We can help you identify the Beneficial Owners to report and offer an in-depth analysis of your fiduciary and corporate structures as needed.

File your CTA with Tax Logicians and know that you have a record of your filings, and with our subscription service you can easily update a filing for any change in Beneficial Ownership.

Subscription Plans

See our reduced rates below for any annual subscription purchase.

Simple Structure Plan

Great for closely held entities.

Single Submission

30€ / £25 / 28 CHF *

Comprehensive Plan

Suited for any entities in a tiered structure or larger companies that have an understanding of who must be reported as a Beneficial Owner.

Annual Subscription

200€ / £175 / 190 CHF *

Secure, encrypted, GDPR & Swiss nFDAP compliant electronic filing through our online portal.

No limits on amendments, corrections, or number of reported owners.

Comprehensive Plan with Analysis

Suited for any entity which needs a US attorney to assist in the determination of Beneficial Owners.

Annual Subscription, Includes 3 hours of analysis by a US attorney.

600€ / £525 / 565 CHF *

Secure, encrypted, GDPR & Swiss nFDAP compliant electronic filing through our online portal.

No limits on amendments, corrections, or number of reported owners.

*Our prices are set in Euros, we then review and adjust other currency charges on a monthly basis, or more frequently in the event of significant fluctuation in exchange rates. We will honour any listed price.